|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

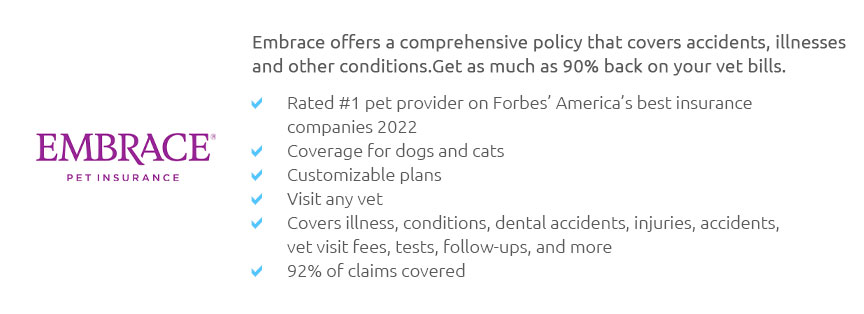

Pet Insurance for Low-Income Families: A Comprehensive GuideIn today's rapidly evolving world, where the bond between humans and their pets grows ever stronger, pet insurance emerges as a significant consideration, particularly for low-income families who may face financial challenges when providing care for their beloved companions. Pet insurance, often perceived as a luxury, is becoming increasingly essential, offering peace of mind and a safety net against unforeseen veterinary expenses. But how exactly can it benefit low-income families, and what should one consider when opting for such a plan? First and foremost, let's explore the fundamental benefits of pet insurance. Much like health insurance for humans, pet insurance helps mitigate the financial burden of veterinary care. Routine check-ups, vaccinations, and unexpected illnesses or accidents can all accumulate into substantial costs. For low-income families, who might already be juggling multiple financial responsibilities, these expenses can prove overwhelming. This is where pet insurance steps in, offering a reprieve by covering a significant portion of these costs, depending on the chosen plan. However, not all pet insurance plans are created equal. It's crucial for families to meticulously evaluate the various options available, focusing on coverage details, premium costs, and claim processes. While some plans cover only accidents and illnesses, others may include preventive care, which could be beneficial for maintaining a pet's overall health. Families should prioritize plans that align with their financial capabilities and the specific needs of their pets. One might argue that the monthly premiums could be an additional financial strain. Yet, when weighed against the potential costs of emergency surgeries or treatments, pet insurance often proves to be a cost-effective investment. Furthermore, many insurers offer flexible payment plans or discounts for multiple pets, making it a more accessible option for families on a tight budget. Beyond the immediate financial relief, pet insurance can also have a profound emotional impact. Knowing that one can afford necessary care provides a sense of security, allowing families to focus on the joy and companionship that pets bring, rather than the anxiety of potential costs. This emotional peace is particularly invaluable in low-income households, where financial stressors are already prevalent. In conclusion, while the concept of pet insurance may initially seem daunting for low-income families, it offers a viable solution to ensure that pets receive the care they deserve without causing undue financial strain. By carefully selecting a plan that fits their budget and needs, families can safeguard their pets' health and, in turn, enhance their own quality of life. Frequently Asked QuestionsIs pet insurance really worth it for low-income families? Yes, pet insurance can be a valuable investment for low-income families as it helps manage unexpected veterinary expenses and provides financial peace of mind. What factors should be considered when choosing a pet insurance plan? Families should consider coverage details, premium costs, deductible amounts, and the reputation of the insurance provider. It's essential to choose a plan that aligns with the specific health needs of their pet. Are there any affordable pet insurance options available? Yes, many insurance companies offer basic plans at a lower cost that cover accidents and illnesses, and some provide discounts for insuring multiple pets or opting for annual payments. Does pet insurance cover pre-existing conditions? Generally, pet insurance does not cover pre-existing conditions, so it's advisable to insure pets while they are young and healthy to avoid exclusions. Can pet insurance be used at any veterinary clinic? Most pet insurance policies allow you to use any licensed veterinarian, but it's important to verify this with the insurance provider before purchasing a plan. https://animalfoundation.com/get-pet-help/pet-resource-center/Financial-Aid-for-Pets

FVHP staff works with both the veterinarian and the family to provide pets with the necessary medical treatment. The Magic Bullet Fund: www.themagicbulletfund. https://www.waggle.org/learning/assistance-for-low-income-pet-families

Indeed, Waggle has been working tirelessly for nearly five years, offering a viable solution for low-income and fixed-income families to find the finances ... https://nevadaspca.org/medical-assistance/

Nevada SPCA Pet Medical Support. Nevada SPCA Community Support Program is a grant supported program to help keep pets with their families. If you are ...

|